Meteora: Restoring Solana's Liquid Dynamics

Meteora is a DeFi protocol on Solana building next-generation liquidity infrastructure to optimize yields, capital efficiency, and risk management for both individual users and protocols. Through its core products, Meteora allows anyone to earn institutional-grade yields on their crypto assets with just a few clicks.

Overview

Meteora is building next-generation DeFi infrastructure to optimize yields, capital efficiency, and risk management for liquidity providers on Solana. Its core products include Meteora Vaults that distribute assets across lending pools to generate automated yields, Dynamic AMM Pools that allow earning additional returns from lending alongside swap fees, Multitoken Stable Pools that aggregate liquidity for diversification, and Non-Pegged Stable Pools that maintain pegged value of volatile assets. By innovating automated liquidity management, Meteora unlocks the full potential of Solana DeFi through maximized earning opportunities, efficient capital usage, and streamlined liquidity provisioning across lending and trading markets. The products pave the way for Solana to emerge as a leading DeFi ecosystem.

DeFi Ain’t Easy…

Manually optimizing yields and managing risks across DeFi protocols is extremely difficult for an average users. It requires continuously tracking yield changes and rebalancing positions, which is operationally intensive. Automation through smart contracts is needed to make decentralized liquidity management feasible.

However, building effective automation is challenging. It involves integrating across multiple yield generating platforms and implementing complex allocation strategies that balance yield optimization with appropriate risk management. Additional factors like maintaining accessibility of funds and insulating against connected protocol risks also need consideration.

Similar to individual users, assets held in protocol treasuries and wallets also suffer from yield optimization challenges. The difficulty of aggregating optimal returns across lending markets means potential earnings are left on the table.

This forces protocols to subsidize yields through heavy liquidity mining rewards but this is ultimately unsustainable(remember DeFi summer?). Building an in-house yield aggregator and risk monitor requires substantial resources - time and effort protocols may prefer directing to their core use cases. Yield optimization is not the core competency of protocols focused on domains like DEXs or DAOs. Yet maximizing earnings on treasury holdings and user deposits is critical for sustainability.

Meteora's plug-and-play vault infrastructure offers the perfect solution - easy access to institutional-grade yields, risk management, and capital efficiency. By outsourcing yield generation to specialized infrastructure, protocols can focus on their core value proposition while optimizing passive earnings.

Given these hurdles, purpose-built solutions that automate yield generation, risk mitigation, and liquidity optimization are essential for enabling mainstream DeFi adoption. The average user needs institutional-grade liquidity infrastructure that removes the burdens of manual yield optimization and risk management.

Liquidity Management in 2023

Let’s take Uniswap as a prime example - providing liquidity on Uniswap V3 is risky - over half of LPs lose money due to the complex calculations required to profitably set concentrated price bands. LPs amplify divergence losses for more fees, requiring specialized knowledge to avoid losses.

LP management on V3 is also highly time-consuming with constant monitoring and rebalancing needed. Most protocols lack dedicated team members solely focused on concentrated liquidity strategies and recruiting this expertise is challenging.

Novel mechanism like protocol-owned liquidity (POL), popularized by Olympus DAO aimed to tackle the problem of fleeting native token liquidity in DeFi by having protocols permanently acquire liquidity through discounted bonding programs. In theory, this creates sustainable, owned liquidity that persists regardless of volatility.

However, POL has so far failed to gain widespread traction due to capital inefficiency issues. The discounted bonding model has struggled to attract adequate liquidity to meaningfully fortify pools. And the opportunity cost of locking capital in POL versus higher yielding opportunities has not resonated with users

Meteora’s Approach to Liquidity

Dynamic Vaults

Meteora's Dynamic Vaults enable automated yield optimization and risk management for liquidity providers on Solana. Users can deposit and withdraw assets from the vaults anytime.

Each vault holds a single token asset like USDC or SOL. The majority of deposited capital is allocated across various Solana lending protocols like Tulip, Solend, and Port Finance to earn yield. Allocation logic maximizes returns while mitigating risks.

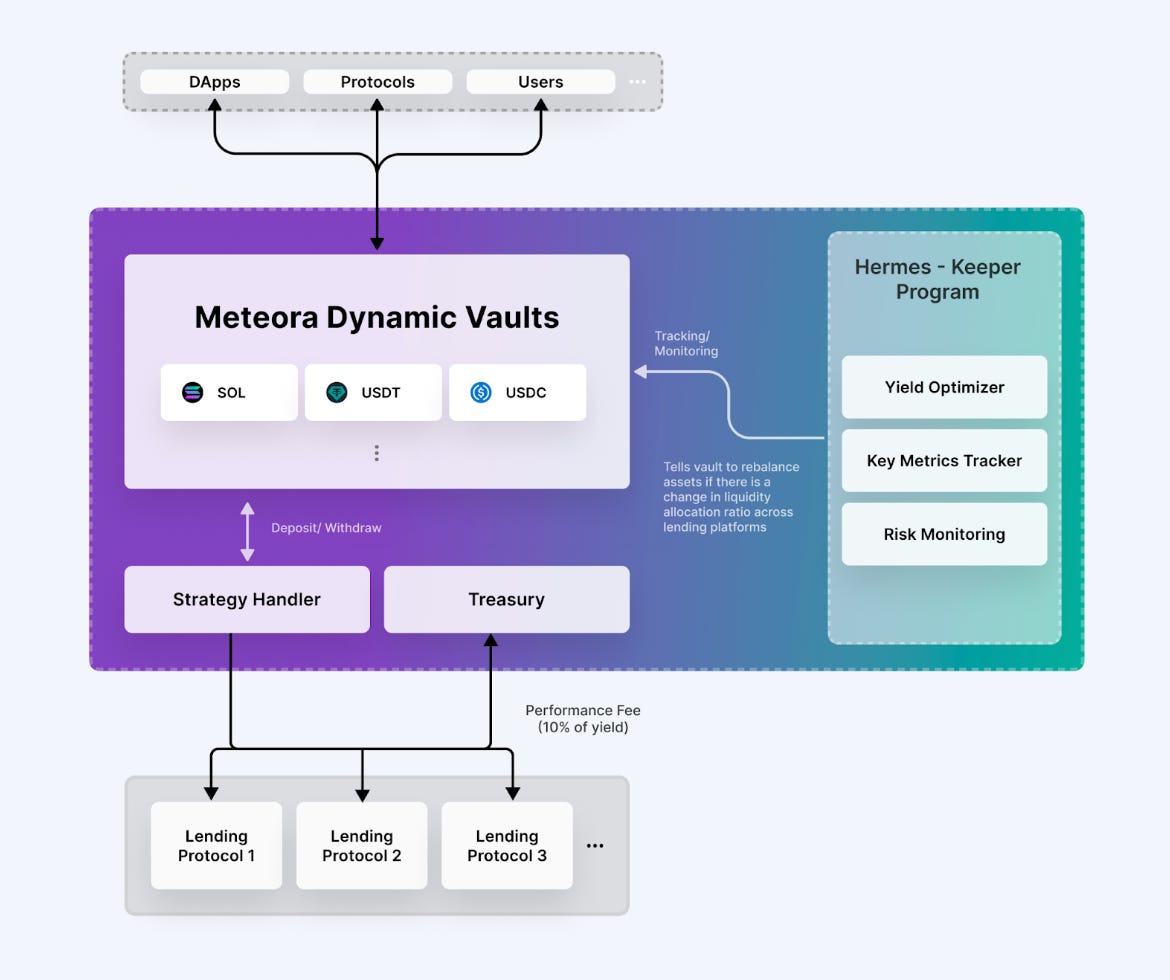

The vaults have three core components:

The Vaults act as the storage and allocation engine for each token. They interact with lending platforms based on instruction from the Keeper (Hermes).

The off-chain Keeper handles complex automation logic. It continuously monitors lending rates and calculates optimal allocation across platforms to maximize APY. The Keeper also tracks key data like deposit APYs and utilization rates to manage risks. If thresholds are breached, it triggers withdrawals to safeguard funds.

The SDK provides easy integration APIs and code samples for protocols and apps. This enables plug-and-play depositing/withdrawing from vaults and distributing yields back to users

Keeper - Hermes

Meteora has created an off-chain keeper called Hermes to handle complex automation logic for the vaults. Hermes manages operations like monitoring lending protocols, calculating optimal liquidity allocation across platforms, and executing rebalances. There are three main operations handled by the Hermes keeper:

Yield Optimizer - The Keeper calculates optimal allocation across lending platforms to maximize overall APY for the vaults. This requires pooling key data like deposit APYs, utilization rates, and liquidity levels from the platforms. The Keeper rebalances allocation if the new calculated distribution diverges from current allocation.

Metrics Tracker - The Keeper also continually tracks and stores metrics like deposit APYs and liquidity levels for use in optimization calculations and risk monitoring. This data is exposed to integrators for display in UIs.

Risk Monitoring - Additionally, the Keeper monitors utilization rates and reserve levels, ready to trigger withdrawals if thresholds are breached to safeguard funds. For example, if a lending pool's utilization rate exceeds 80%, the Keeper will withdraw all liquidity and pause deposits for investigation.

By automating optimization and risk management, the vaults offer institutional-grade liquidity infrastructure for Solana DeFi. Users simply deposit into the vaults and the system handles maximizing yields across lending protocols within defined risk guardrails.

Dynamic AMM Pools

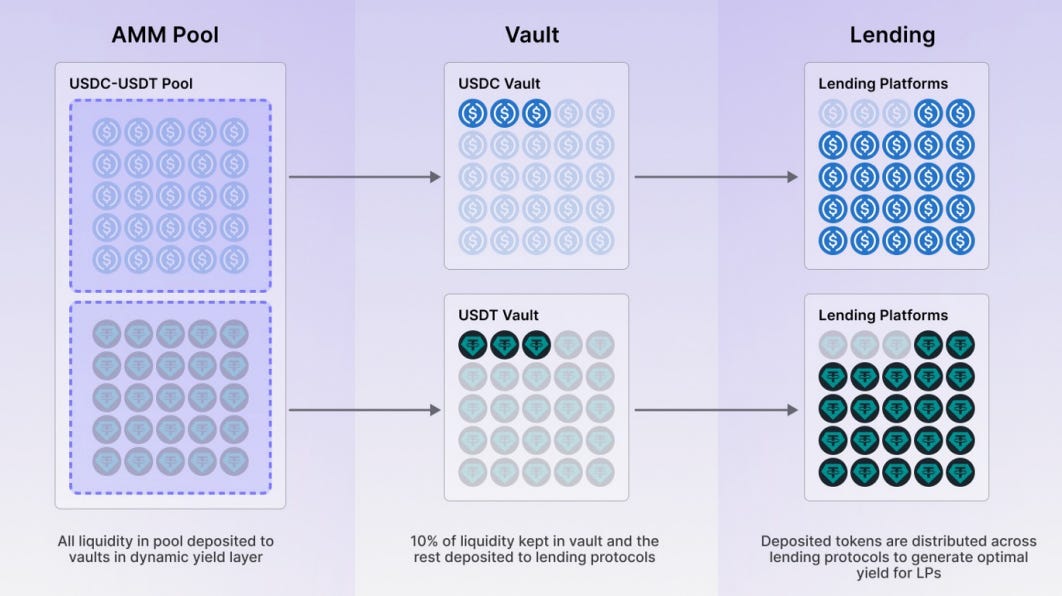

Meteora's first product built on the Dynamic Vaults yield infrastructure will be AMMs. The current AMM pools will be incrementally replaced with new pools leveraging the vaults.

From a user perspective, the pools will function like any other traditional liquidity pool. However, underneath the hood, assets will be deposited into the yield-optimizing vaults and allocated across lending platforms to generate returns for LPs.

This allows LPs on the new AMMs to earn yield from multiple sources:

Interest from lending platforms

Trading fees from the AMMs

LM incentives from protocols

Meteora's own LM incentives

By plugging into the institutional-grade yields of the Dynamic Vaults, the next-generation AMMs will provide a significantly enhanced earning experience for LPs. The vault automation handles optimizing lending returns so LPs can passively benefit.

Stress Testing in the Wild

Meteora's Dynamic Vaults underwent extensive real-world testing during the beta development phase. Two major exploits in Solana DeFi provided valuable case studies for analyzing the effectiveness of the vaults' risk management capabilities.

Mango Markets Exploit

In October 2022, an exploiter drained over $100M from Mango Markets via an oracle manipulation attack. At the time, Meteora had allocated some liquidity to Mango for yield optimization. Although the impact was limited due to deposit caps, around $900K USDC ended up locked on Mango before withdrawals could be triggered.

This case highlighted areas where Meteora's risk mechanisms could be improved. Mango eventually reimbursed the funds, but direct withdrawals may have been possible with enhanced safeguards.

Solend USDH Exploit

In November 2022, an exploiter inflated the USDH stablecoin price via a Saber oracle attack, draining Solend's isolated pools. Although Meteora did not directly interact with USDH, its vaults had UXD exposure on Solend's Stable and Coin98 pools.

However, Meteora's Keeper detected the rising utilization signals in real-time. It immediately triggered withdrawals to pull all UXD assets safely back into the vaults before losses occurred.

Together, these exploits validated the effectiveness of Meteora's monitoring infrastructure and risk management automation. The system was able to automatically detect anomalies and take action to safeguard funds.

AMM Pools

Currently, the vast majority of assets deposited in AMM pools remain unutilized, only a small portion is actively used for swaps. As a result, yields generated by the dormant capital are insufficient to attract liquidity providers (LPs), requiring heavy LM incentives.

However, by building AMMs on Meteora's yield infrastructure, idle capital can be put to work.

Let's look at an stSOL-SOL pool as an example:

All stSOL and SOL tokens deposited into the AMM pool get sent to the corresponding stSOL and SOL vaults.

Each vault keeps 20% as reserves for the AMM's swaps and withdrawals.

The remaining 80% of previously dormant stSOL and SOL get allocated by the vaults across lending platforms like Tulip, Apricot, and Port Finance to earn additional yield.

The yield optimizer continually recalculates allocation across platforms to maximize APY.

Instead of most assets laying idle, the majority of stSOL and SOL from the AMM pool now actively generate yield via the automated vault infrastructure. This unlocks significant capital efficiency to provide sustainable returns beyond swap fees.

By leveraging the yield layer, AMMs can reduce reliance on LM incentives to attract LPs. Idle capital put to work via optimized lending enables compelling sustainable yields for liquidity providers.

Unlocking Solana's Liquidity Potential

Solana currently ranks 11th in TVL across L1/L2 blockchains and has seen a massive decline in its liquidity market share. In my opinion, this is about to change…

DeFi protocols compete on dimensions like liquidity, trust, returns, fees, usability, composability, capital efficiency, scalability, and specialization.

Of these, liquidity is currently the most critical factor, as deep liquidity attracts users and volume. Models hindering liquidity growth through high fees are disadvantaged, as open-source code enables copying with lower fees. Declining DeFi fee percentages reflect the intense liquidity competition among protocols.

Of course, building trust via strong teams, brands, and audits also remains vital for adoption and safety. However, no one dimension alone is sufficient. The most successful DeFi protocols will optimize across all key factors in a balanced way.

This is exactly what Meteora's Dynamic Vaults aim to achieve for Solana DeFi. The vaults aggregate liquidity across users and protocols into shared pools, increasing capital efficiency. This directly enhances the most important dimension of liquidity depth. Automated yield optimization significantly boosts returns for liquidity providers and seamless composability with any Solana protocol improves interoperability.

Parting Thoughts

The benefits of Meteora's vaults extend beyond individual users to decentralized apps, DAOs, and protocols. Many hold sizable treasuries that remain idle or underutilized. With a straightforward SDK, the vaults are designed for seamless integration.

This positions the infrastructure to serve as the yield layer for all of Solana. Any entity with passive liquidity can plug into optimized lending yields. Assets that previously laid dormant can now grow safely and sustainably while remaining liquid.

Robust risk monitoring protects user funds while maintaining continuous liquidity access. By innovating on core areas like liquidity aggregation, yield generation, and risk management, Meteora elevates the key dimensions where Solana DeFi is currently most underserved. The vault infrastructure upgrades fundamental performance metrics across returns, efficiency, and safety — and the rising tide of optimized liquidity lifts every integrated protocol building on Solana. This comprehensive improvement to foundational DeFi infrastructure will compound benefits across Solana DeFi as adoption grows.